CFO KPIs for 2025: A Guide to Top Dashboards for Tracking Financial Success

The role of the Chief Financial Officer in 2025 is more important and involved than ever. It is no longer limited to the management of budget and crushing figures, today’s CFO are the most important strategic partners who are successful. They rely on smart data, powerful insights, and advanced equipment to pursue their companies. At the heart of this shift are clear, targeted Key Performance Indicators (KPIs) and smart financial dashboards that help support performance, spot trends and long-term development.

Explore the essential CFO KPIs for 2025 and the best financial dashboards that empower CFOs to monitor business performance effectively. Plus, get a simple CFO guide to selecting the best KPIs that match business goals and support smart choices.

Understanding CFO KPIs for 2025

CFO KPI for 2025 is not just about tracking numbers; they are in the process of gaining actionable rich insights that are in accordance with the company’s strategic purpose. These KPIs provide a comprehensive approach to economic health, operational efficiency and risk management. Traditional metrics are insufficient for modern business models, mainly those with recurring revenue streams. Instead, CFOs should focus on KPIs that provide real-time, actionable insights.

Key CFO KPIs to Monitor

- Gross Margin Percentage: Shows how much profit is made after covering the cost of goods, helping track pricing and production efficiency.

- Operating Cash Flow: This tells how much cash the business makes from daily operations, showing overall financial health.

- Accounts Receivable Turnover: This metric considers the company collecting revenues from customers.

- Debt-to-Equity Ratio: It evaluates the company’s financial advantage and risk by comparing the total obligations of equity to the shareholders.

- Return on Equity (ROE): Roe measures profitability in relation to the equity of the shareholders and shows how equity is used.

These CFO KPIs for 2025 play an important role in giving a comprehensive approach to the company’s financial results and guiding strategic decisions.

The Role of Financial Dashboards for CFOs

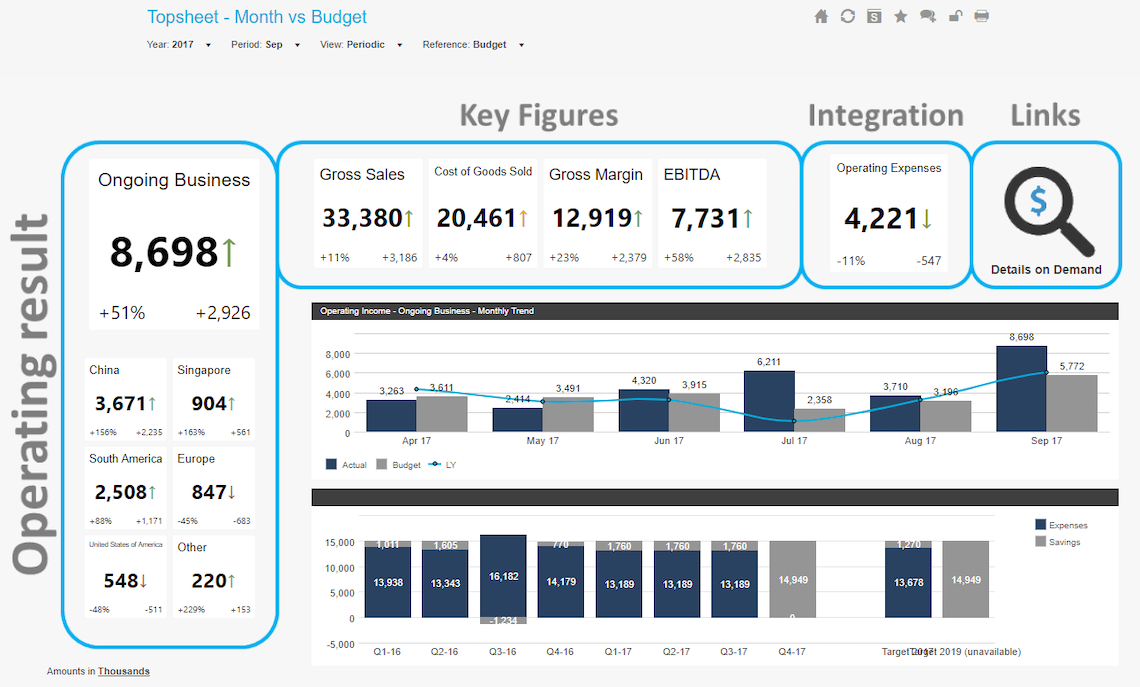

Financial dashboards for CFOs have become inevitable tools for real-time data visualization and decision-making. They consolidate complex financial data into spontaneous, interactive formats, allowing CFOs to monitor business performance seamlessly.

Features of the Best Financial Dashboards for CFOs

- Real-Time Data Integration: Make sure that CFOs have access to the most current financial information.

- Custom Views: This lets you adjust dashboards to focus on the most important KPIs.

- Interactive Charts: This makes it easy to explore data with clickable charts and details.

- Predictive Analytics: Includes forecasting tools to estimate future financial trends and challenges.

The best financial dashboards for CFOs empower them to not only track current performance but also to predict and plan for future financial scenarios.

Top Tools for CFO Dashboards

Here are some easy-to-use tools that help CFOs create and manage financial dashboards:

- Microsoft Power BI: A popular tool that helps show and understand financial data through visuals.

- Tableau: Easy to use and great for turning data into clear and colorful charts.

- NetSuite: A cloud-based system that comes with built-in financial dashboards.

- Finout: Offers dashboards that help track things like cloud costs.

- Accounting Seed: Lets you build your own financial dashboards the way you need them.

Selecting the Best KPIs: A CFO's Guide

It is important to choose the right KPI for effective financial management. The CFO guide involves adjusting the Matrix for strategic purposes to choose the best KPI, secure data accuracy, and regularly review KPI relevance.

Steps to Select Effective KPIs

- Match Goals: Choose KPIs that support the company’s long-term plans.

- Easy to Measure: Pick KPIs that can be tracked over time.

- Keep It Relevant: Check often to make sure KPIs still fit the business needs.

- Be Clear: Use KPIs to share progress with teams and stakeholders.

By following this CFO guide to selecting the best KPIs, financial leaders can create a strong structure to monitor and improve the results of the business.

Monitoring Business Performance with KPIs and Dashboards

Effective monitoring of commercial performance requires a co-operative approach, a combination of proper KPI with advanced economic dashboard. This integration enables the CFO to identify trends, highlight disabilities and make informed decisions immediately.

Benefits of Integrated Monitoring

- Enhanced Decision-Making: Real-time insights facilitate swift and informed strategic choices.

- Improved Financial Health: Continuous monitoring helps maintain optimal cash flow and profitability.

- Risk Mitigation: Early detection of financial anomalies allows for proactive risk management.

Incorporating CFO KPIs for 2025 into daily operations through financial dashboards ensures that CFOs are well-equipped to monitor business performance effectively.

Wrap Up!

Financial management is changing fast. CFOs need to keep up with new tools and strategies. They can stay ahead of the curve by using the best financial dashboards and choosing the right KPIs. A simple CFO guide to selecting the best KPIs helps them focus on the key numbers that support business goals.

Tracking CFO KPIs in 2025 helps finance leaders see how the business is doing, make better choices, and plan for the future. CFOs can make better decisions that improve daily work with clear data and smart dashboards. These tools also help the business grow, stay strong, and succeed in a changing world.

Get the latest updates and trends only on the HubDigit blog.

FAQs

1. What is the KPI of a CFO?

Some top CFO KPIs might include the accuracy of financial forecasting, the speed (and efficiency) of closing financial books, cost management, leadership qualities and more.

2. What is the CFO financial dashboard?

A CFO dashboard is used by a CFO (Chief Financial Officer) or Finance Director to maintain a high-level overview of the company’s financial health and overall performance.

3. What should be on a KPI dashboard?

Modern KPI dashboards can make use of a wide range of different data visualizations and KPI categories, including conversion rate, revenue growth, churn rate, budget threshold, net profit, share-of-voice (SoV), etc.